Not known Incorrect Statements About Hard Money Atlanta

Table of ContentsUnknown Facts About Hard Money AtlantaThe smart Trick of Hard Money Atlanta That Nobody is Talking AboutFacts About Hard Money Atlanta UncoveredThe Only Guide for Hard Money AtlantaThe Only Guide for Hard Money Atlanta4 Simple Techniques For Hard Money Atlanta

A difficult money funding is merely a temporary lending secured by property. They are moneyed by (or a fund of investors) instead of traditional lenders such as financial institutions or cooperative credit union. The terms are usually around twelve month, yet the financing term can be extended to longer regards to 2-5 years.The amount the difficult cash lenders are able to provide to the consumer is mostly based on the value of the subject home. The property may be one the borrower currently has as well as desires to make use of as security or it might be the residential property the debtor is obtaining. Difficult money lending institutions are primarily worried about the as opposed to the borrower's credit report (although credit scores is still of some relevance to the lender).

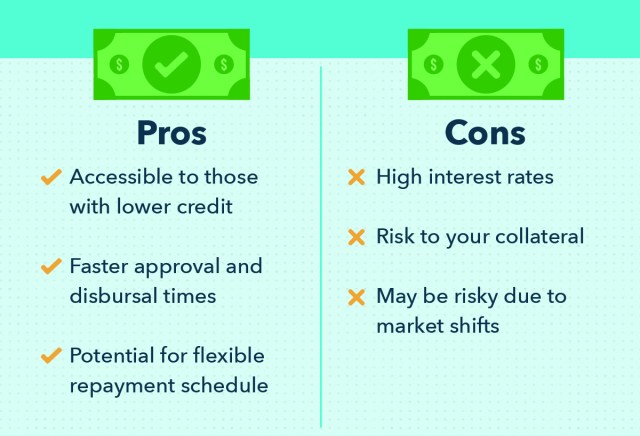

When the financial institutions claim "No", the hard cash lenders can still claim "Yes". A customer can get a hard cash loan on virtually any type of sort of home including single-family domestic, multi-family property, business, land, as well as commercial. Some tough money lending institutions may specialize in one details property type such as domestic and also not have the ability to do land loans, simply because they have no experience in this field.

Our Hard Money Atlanta Ideas

Tough money finances are suitable for situations such as: Land Loans Building And Construction Loans When the Purchaser has credit report concerns. The primary reason is the capacity of the difficult cash lending institution to fund the lending swiftly.

Contrast that to the 30 45 days it requires to get a bank loan moneyed (hard money atlanta). The application process for a difficult cash financing typically takes a day or 2 as well as in many cases, a lending can be accepted the very same day. All the best hearing back regarding a financing approval from your financial institution within the very same week! The ability to obtain funding at a much faster price than a bank loan is a substantial advantage for an investor.

Some Ideas on Hard Money Atlanta You Need To Know

Difficult money lending institutions in California normally have lower prices than various other components of the country given that California has several difficult money offering firms. Boosted competitors leads to a reduction in rates.

Due to this greater risk included on a difficult cash financing, the rates of interest for a difficult cash funding will certainly be higher than standard finances. Rate of interest for tough money lendings vary from 10 15% relying on the specific loan provider as well as the viewed risk of the loan. Factors link can range anywhere from 2 4% of the overall amount lent.

The financing amount the difficult cash loan provider is able to provide is figured out by the ratio of the car loan amount separated by the worth of a building. This is referred to as the finance to worth (LTV). Several difficult cash lenders will lend up to 65 75% of the existing worth of the home.

All about Hard Money Atlanta

This develops a riskier financing from the tough money loan provider's point of view since the quantity of funding placed in by the lender boosts and also the quantity of funding invested by the borrower lowers. This raised threat will create a difficult cash lending institution to bill a greater rate of interest - hard money atlanta. There are some tough cash loan providers that will lend a high percent of the ARV and also will even finance the rehabilitation expenses.

Expect 15 18% rate of interest and also 5 6 points when a loan provider funds a funding with little to no deposit from the borrower (hard money atlanta). Sometimes, it may be beneficial for the customer to pay these excessively high rates in order to secure the offer if they can still generate earnings from the job.

They are much less worried about the consumer's credit score. Concerns on a customer's record such as a foreclosure or brief sale can be ignored if the customer has the funding to pay the discover this rate of interest on the loan. The difficult cash lending institution need to additionally think about the customer's strategy for the building.

What Does Hard Money Atlanta Do?

An additional method to find a difficult money loan provider is by attending your local real estate investor club conference. These club conferences exist in a lot of cities as well as are typically well-attended by difficult cash lenders wanting to network with possible customers. If no hard cash lenders are existing at the conference, ask various other genuine estate investors if they have a difficult cash lender they can recommend.

Exactly how do difficult money car loans function? Is a tough cash lending appropriate for your scenario? Today, we'll address these inquiries, giving you the break down of tough cash fundings.

The Single Strategy To Use For Hard Money Atlanta

With typical loan options, the loan provider, such as a financial institution or credit scores union, will certainly look at your credit history and verify your income to establish whether you can settle the finance. On the other hand, with a hard cash loan, you click here for info borrow money from an exclusive loan provider or specific, and their choice to provide will certainly concentrate on the top quality of the asset.